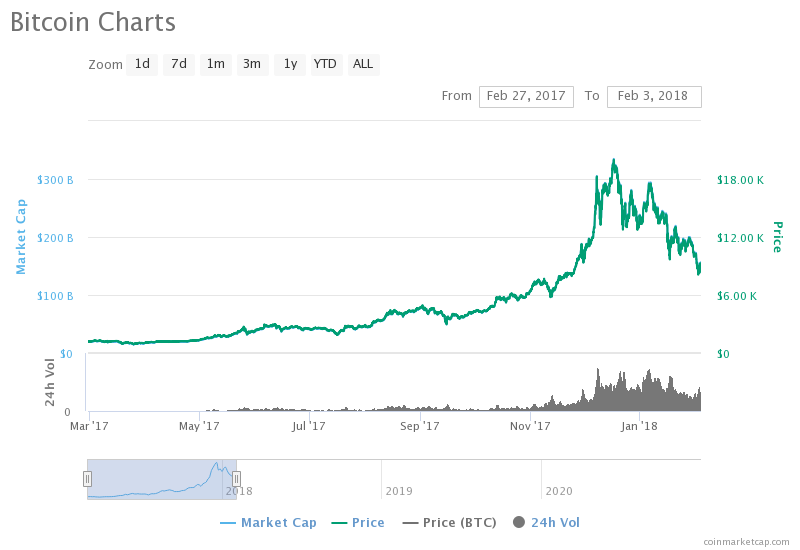

In 2010, the value of a single Bitcoin was $0.09. It took three years for the world’s first cryptocurrency to break $100 and another four years to hit $1,000. But between March 2017 and December 2017, the price of a Bitcoin surged from $1,000 to nearly $20,000 — peaking at $19,783 on Dec. 17.

Bitcoin is once again on a historic tear, but things are different this time around — surpassing $28,000 — and longtime enthusiasts say Bitcoin is here to stay.

The cryptocurrency has become so popular that earlier this week, Carolina Panthers offensive tackle Russell Okung negotiated half of his $13 million contract to be paid to him in Bitcoin, according to the Bleacher Report.

Panthers OT Russell Okung will get half of his $13M contract paid in bitcoin ? @brgridiron pic.twitter.com/SAZsqeEALy

— Bleacher Report (@BleacherReport) December 29, 2020

“The next decade will be about bitcoin’s mass adoption,” Okung tweeted on Tuesday.

As a decentralized currency that relies on neither the government nor traditional banking institutions, Bitcoin has the potential to eliminate the need for third-party financial transactions — an “alternative financial system,” according to Satoshi Nakamoto, a pseudonym for the person or group of people widely credited with creating Bitcoin.

In theory, transferring funds through Bitcoin can be accomplished using an open-source software maintained by individuals who are rewarded for verifying the ever-increasing blockchain ledger, avoiding institutions that take a cut of profits and exchanges from processing fees — though in practice, cryptocurrency exchanges and third-party institutions have stepped in to facilitate many Bitcoin transfers.

The rise of Bitcoin in 2017 brought a surge of attention to the fringe currency — after spending the first nine years of its existence relegated primarily to black market purchases on sites such as the anonymous online market Silk Road, Bitcoin ended 2017 as the second-most searched term on Google for global news that year, with searches spiking 25-fold by December 2017 compared to March of that year.

But by February 2018, the value of one Bitcoin was cut to less than half of its December high. Trading volume at the time surged to as much as $20 billion worth of trades in 24 hours before falling back below $10 billion for most of 2018.

By the end of 2018, Bitcoin had fallen to a low of $3,200. The ensuing period between January 2019 and September 2020 was marred by erratic price fluctuations — breaking $11,000 in June 2019, cratering with the rest of the stock market in March, and recouping modest gains by the end of the third quarter.

Since late September, when the cryptocurrency once again broke past $10,000, Bitcoin returned to a monthslong rally, smashing the $20,000 mark for the first time on Dec. 16, almost exactly three years after initially approaching that valuation. But unlike 2017, Bitcoin’s 2020 bull run hasn’t stopped — on Wednesday, Bitcoin traded at more than $28,000.

Bitcoin advocates such as Michael Saylor, CEO of business intelligence company MicroStrategy, argue that as cryptocurrencies continue to enter the mainstream, Bitcoin will transition from a speculative investment to a “safe-haven asset.”

Another longtime Bitcoin Bull, Gemini co-founder Tyler Winklevoss, who with his brother Cameron Winklevoss reportedly owns nearly 1% of the Bitcoin market alone, told CNBC last week that Bitcoin would “disrupt gold” and surge as much as 25 times its current valuation.

Saylor’s company announced last week that it has purchased more than $1 billion worth of Bitcoin in 2020 — most recently a Dec. 21 purchase of 29,646 coins worth nearly $22,000 apiece, a roughly $650 million investment suggesting that the company expects a Bitcoin worth more than $20,000 is here to stay.

“The Company continues to believe bitcoin will provide the opportunity for better returns and preserve the value of our capital over time compared to holding cash,” company President and CFO Phong Le said. “We also remain dedicated to our customers and our goal of operating a growing profitable business intelligence company.”

MicroStrategy isn’t the only publicly traded company trying to cash in on Bitcoin. Grayscale, a $16.3 billion digital asset investment firm, holds more than $7.4 billion worth of Bitcoin in its Bitcoin trust fun — capturing 2% of the entire Bitcoin market.

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments,” Nakamoto wrote in his 2008 Bitcoin white paper, in which he outlined how such an anonymized currency system could be structured. “What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

Catching the eye of large investors is key to fueling Bitcoin’s current surge: Trading volume has surged as much as three times that of 2017 peak trading levels, and increased activity typically coincides with big market booms — and busts.

Bitcoin now also face competition from other cryptocurrencies such as Litecoin, Ethereum, and Binance. Even Facebook announced last year that it was in the process of developing its own digital currency, and in October, the Bank of International Settlements published a report with the central banks of Europe, England, Japan, and Canada and the Federal Reserve outlining how central banks could embrace blockchain transactions (the mechanism behind cryptocurrencies) and eventually develop a central banking digital currency.

That competition, which increases general awareness and interest in cryptocurrencies, led the federal government’s Financial Crimes Enforcement Network earlier this month to introduce new regulations specifically targeting cryptocurrency transactions. Although critics have lambasted the new regulation as “at minimum, a complete pain in the ass,” according to the Verge, a sufficient regulatory framework surrounding cryptocurrency is vital to attracting the interest of traditional banks and big investors — the real movers of the market.

A decade of FUD: “governments will ban Bitcoin and kill it.”

Reality: Governments attack weak crypto projects and end up showing Bitcoin’s true value.— Jameson Lopp (@lopp) December 29, 2020

As of yet, there’s still no clear path forward for Bitcoin and other cryptocurrencies to burst into the mainstream. Fears surrounding anonymous and illegal transactions and a lack of sufficient government involvement, at times seen as antithetical to trends in the cryptocurrency movement, have led all five of the largest credit card issuers to institute partial or complete bans on cryptocurrency transactions, according to Banks.com.

Bank of America Corp. CEO Cathy Bessant told CNBC in 2019 that cryptocurrencies were “troubling” given their lack of transparency.

“As a payment system, I think it’s troubling, because the foundation of the banking system is on the transparency between the sender and the receiver, and cryptocurrency is designed to be nothing of the sort. In fact [it’s] designed to be not transparent,” Bessant said. “The way we sort of quote-unquote catch bad guys is by being transparent in the financial moment of money. Cryptos is the antithesis of that.”